Unlocking Financial Opportunities: Hard Money Lendings for Quick Money

What exactly are tough money financings, and exactly how can they unlock monetary opportunities? Furthermore, we will certainly provide understandings on locating the right hard cash lender and ideas for successful loan repayment. If you're looking to tap right into the globe of tough cash fundings for fast cash, keep checking out to find a world of economic possibilities.

The Fundamentals of Tough Money Fundings

Tough money car loans, additionally understood as personal cash lendings, are a sort of financing frequently made use of by investor and people looking for quick money. These finances are typically secured by the value of the building being acquired or made use of as security. Unlike typical financial institution loans, hard money lendings are funded by private individuals or firms, which allows for more flexibility and faster approval processes.

Among the vital attributes of tough cash loans is their fast turn-around time. Conventional small business loan can take weeks and even months to be approved and moneyed, while tough money finances can usually be refined within days. This makes them an eye-catching alternative for consumers who need prompt accessibility to funds for time-sensitive jobs or investments.

Another vital facet of difficult cash lendings is their asset-based nature. Lenders primarily concentrate on the value of the building being utilized as collateral, instead than the debtor's credit report or revenue. This indicates that even consumers with less-than-perfect credit history or irregular income streams might still be able to get approved for a hard cash funding.

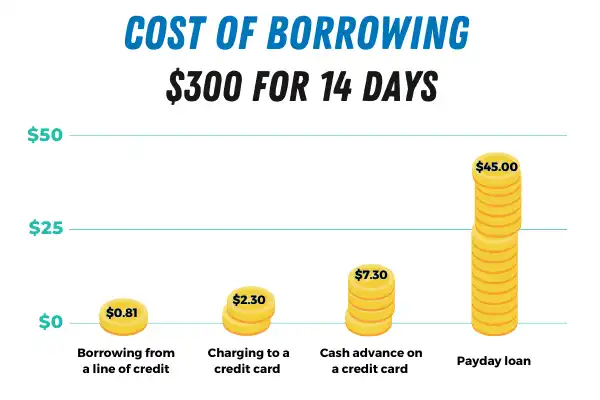

It deserves noting that hard cash car loans typically have higher interest rates and charges contrasted to conventional small business loan. This is because of the higher risk included for loan providers, along with the quicker authorization and financing process. For borrowers in demand of quick money or that may not certify for conventional financing, hard money finances can give an important service.

Advantages of Hard Cash Car Loans

One of the crucial benefits of tough money fundings is their flexibility and rapid approval process. Unlike traditional small business loan that have rigorous criteria and extensive authorization durations, tough money finances can be gotten swiftly and with less paperwork. This is especially beneficial for actual estate financiers or companies in need of prompt funds for home purchases, renovations, or various other time-sensitive jobs.

Moreover, difficult cash loans provide more flexibility in terms of repayment options. Conventional fundings commonly come with inflexible settlement timetables and fines for very early settlement.

Just How to Get approved for a Tough Money Lending

To effectively protect a tough money finance, borrowers should meet particular needs that surpass typical credit reliability analyses. While credit report history and income are still considered, hard cash loan providers mainly focus on the value of the residential property being made use of as collateral - hard money loans in ga. Below are the essential certifications borrowers require to satisfy in order to get a difficult money car loan

Firstly, debtors should have a clear plan for just how they mean to use the car loan and just how they prepare to settle it. Difficult money lending institutions wish to see that the borrower has a strong method in position to make certain the lending will be repaid in a timely way.

Second of all, consumers require to have an adequate amount of equity in the home they are using as collateral. Tough cash loan providers typically need a loan-to-value proportion of no greater than 70-80%. This implies that the property being utilized as security must have a higher worth than the car loan quantity.

Last but not least, consumers must have a trusted departure strategy. Tough money finances are generally short-term car loans, ranging from a couple of months to a couple of years. Lenders desire to see that consumers have a plan to either sell the residential property, refinance with a traditional loan provider, or have sufficient money circulation to pay back the financing when it comes due.

Finding the Right Hard Cash Loan Provider

When seeking a suitable difficult cash lending institution, it is essential to very carefully review their credibility, financing, and experience criteria. The experience of a tough cash loan provider is a critical variable to take into consideration. Try to find lending institutions that have been in the industry for a number of years and have a record of effective deals. Experienced lenders are more most likely to comprehend the complexities of hard cash providing and can offer important insights and guidance throughout the financing procedure.

Reputation is another key factor to consider when picking a hard money lender. A reputable lender will certainly have favorable responses from previous clients and a strong online reputation in the sector.

Offering standards is the third element to assess. Different hard money loan providers may have differing requirements, such as the kinds of residential or commercial properties they fund, loan-to-value proportions, and required credit rating. Make sure the loan provider's standards straighten with your details demands and objectives.

Tips for Successful Difficult Cash Lending Repayment

Effectively paying off a tough cash loan requires careful planning and economic self-control. Unlike Find Out More conventional fundings, difficult money loans typically have much shorter terms and greater rate of interest. To make certain an effective settlement, debtors need to consider the following suggestions.

Firstly, it is important to thoroughly analyze your monetary scenario before getting a difficult cash lending. Review your earnings, expenses, and existing financial debts to figure out if you can conveniently fulfill the finance repayments. It is essential to have a realistic payment plan in place.

Second of all, prioritize your car loan settlements (hard money loans in ga). Difficult cash financings commonly include higher passion rates, so it's crucial to allot adequate funds to Discover More Here meet the monthly payments without delay. Take into consideration establishing up automated settlements to avoid any late fees or penalties

Furthermore, it is advisable to have a back-up strategy in case of unpredicted conditions. Establish a reserve to cover unexpected expenditures or potential delays in financing repayment. This will supply a safeguard and help avoid skipping on the loan.

Finally, preserve open interaction with your tough cash lender. If you visit experience any kind of troubles or economic obstacles, inform your lender right away. They might have the ability to give assistance or offer alternative settlement choices.

Conclusion

:max_bytes(150000):strip_icc()/GettyImages-1137516784-604537c07dad40eea021db81f5527ecf.jpg)

Tough cash financings, additionally recognized as exclusive cash financings, are a kind of funding generally made use of by real estate investors and people in need of quick cash money. Unlike standard financial institution lendings, hard cash finances are funded by private people or companies, which permits for even more flexibility and faster authorization processes.

Traditional financial institution financings can take weeks or also months to be approved and moneyed, while difficult money financings can commonly be processed within days.It is worth noting that hard money loans commonly have greater interest prices and fees contrasted to standard financial institution loans. Unlike traditional loans, hard money fundings usually have much shorter terms and higher passion rates.